Investments in key sustainability sectors could help to strengthen the pace of Latin America’s economic recovery in a post-COVID-19 world, though the region needs to offer more ESG-qualifying assets to do so, experts say.

Global funds that invest under ESG principals topped $1 trillion in assets under management amid the COVID-19 crisis, according to data compiled by Morningstar. Attracting a portion of this capital could be crucial for a region that has been ravaged by the pandemic, with more than a quarter-million deaths as of Sept. 1 and record-level GDP economic contractions and job losses in several countries.

The crisis is already widening socioeconomic disparities in Latin America, according to a report the Inter American Development Bank. The region is set to be among the hardest hit economically, and is expected to have one of the world’s slowest recoveries.

Taking advantage of ESG momentum, experts say, could help both temper the negative economic impact of COVID-19 and strengthen a recovery.

“ESG is an important trend for Latin America to take into account in order to attract international investors,” said Maria Netto, a green finance specialist with the Inter-American Development Bank. “Market share is very small and there is a lot of potential to grow.”

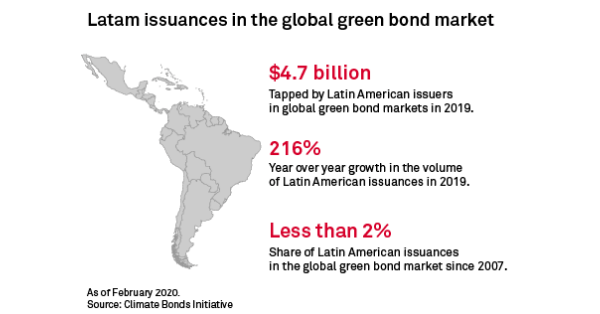

While home to the Amazon rainforest, one of the world’s most biodiverse and ecologically important areas, a fraction of the global green markets actually target Latin American assets.

Internationally, green bond markets reached $258.9 billion in 2019; but less than 2% of those issuances were tied to Latin America, data from Climate Bond Initiative shows. Similarly, a Bank of America survey showed that just 0.5% of equity assets under management from Latin America foreign funds have an ESG focus; that compares to the 3% to 4% average seen in other parts of the world.

Domestic ESG investment is also anemic. In Brazil, ESG-focused equity funds manage just 611.5 million reais, or 0.12% of the country’s market.

There is hope, however, that those figures can and will grow — and grow rapidly — as the COVID-19 pandemic has pushed ESG awareness to the forefront.

“Opportunity to do eco-business and to put value to LatAm’s large stock of natural resources is huge,” the IADB’s Netto said. A lack of funding, she argued, creates opportunities in a myriad of sectors such as sustainable agribusiness, sewerage, garbage disposal and infrastructure.

That sentiment was echoed by Principles for Responsible Investment, an UN-backed think tank. Eduardo Atehortua, the group’s Latin America head, urged governments to “prioritize the delivery of resources [and] aid for those sectors best positioned to generate quality and stable employment in the coming years,” in a recent statement. He pointed specifically to areas like renewable energies, sustainable construction, efficient water management, regenerative agriculture, protection of biodiversity and sustainable tourism.

“All these sectors are a reality and can be consolidated as driving forces of the economy in coming decades,” Atehortua said.

For potential investors, however, there is still “a problem with supply,” Gustavo Pires, a partner with Asset Management services with XP Inc, told Market Intelligence. XP, a major online brokerage based in Brazil, launched a series of ESG-related funds in June. It allows investors to jump in with as little as 100 reais, or less than US$20 at current exchange rates. The goal, Pires said, is to “popularize” ESG products into something that is not exclusively geared toward “wealth” clients.

But he also noted that “when talking about assets, we don’t have a huge number of companies we can select for real ESG.”

The push to correct that has started to build. Some have warned that embracing ESG standards is not only key to attracting new capital, but also to hold onto current investors.

In Brazil, a group of former presidents and Banco Central do Brasil chiefs signed a joint letter urging the government to pursue a “green recovery.” The crisis, they argued, “opens up a possibility of resuming activity and, simultaneously, building an economy more resilient to climate risks.”

“Failure to take into account sustainability frameworks might scare away investments as companies might choose to avoid a country which does not adequately respect environmental rules,” Marcel Balassiano, an economist with Brazilian think tank Getulio Vargas, said in an interview. In late June, a series of international asset managers threatened to curb their investments in Brazil should the government fail to rein in on deforestation.

Beyond the immediate urgency stemming from the pandemic, experts argue that improving corporations’ long-term ESG ratings is vital for unlocking broader economic potential. Recently, the largest banks in Brazil inked an agreement to support sustainable development in the Amazon region, a decision analysts say could help attract investors.

“If some of the pandemic recovery efforts were directed at enhancing companies’ ESG, and especially social performance, this could stimulate economic growth,” Ben Caldecott, Director of the Oxford Sustainable Finance Programme at the British university, said in an emailed response to questions. “Policymakers should encourage the adoption of ESG practices by companies as such efforts can enhance long-run macroeconomic performance.”

In a recent study, Caldecott found a positive correlation between average ESG scores from companies and their native countries’ GDP performance. The report, based on countries including Brazil and Mexico, supports the argument that a green recovery could provide a number of longer-term benefits beyond the realm of environment and social issues themselves.

The overarching result of the study, he said, was that a country’s GDP per capita improved by when companies’ increased their average E, S or G scores. The governance, or G, score offered the strongest average GDP per capita gain, at 0.19% for every unit of score improvement; the per capita GDP rise for each unit of environmental or social score improvement was 0.06% and 0.10%, respectively.

“Across the sample group, an increase of firms’ ESG performance in a country is associated with a positive, statistically significant effect on living standards in that country, as measured by GDP per capita,” Caldecott said.

As of Sept. 1, US$1 was equivalent to 5.37 Brazilian reais.

Author: David Feliba – S&P Global

Stay updated on the latest trends of Green Finance

Stay updated on the latest trends of Green Finance