- Green Finance

- Scope of Activities

- Countries

- Map

- Why

- Success Cases

- Partners

- Resources

- Others Initiatives

- Home

- »

- Our Initiatives

- »

- Green Finance

Green Finance

Green finance is a broad term that refers to increasing the level of financial flows (from banking, microcredit, insurance and investment) from the public and private sectors towards sustainable development priorities. Green finance includes, but is not limited to, climate finance. Read MoreGreen finance comprises:

- components of the financial system that deal specifically with green investments, including their specific legal, economic and institutional framework conditions;

- the financing of public and private green investments in different areas, including:

- provision of environmental goods and services,

- prevention, minimization and compensation of damages to the environment and to the climate

- the financing of public policies that encourage the implementation of environmental and environmental-damage mitigation or adaptation projects and initiatives.

Green finance Initiative (GFI) strives to increasing the level of financial flows from financial institutions, investment funds, insurance and also micro credit, available to the public, private and not-for-profit sectors to implement sustainable development goals.

The GFI aims to support National Development Banks (NDBs), Agencies and Local Financial Institutions in the promotion of financing strategies geared to mobilize private sector green investments.

Scope of Activities

Green Banks

Tailored support for National Development Banks to design and promote green financial instruments; Structuring a green financing strategy, including strengthening of its institutional capacity for NDBs.

Innovative Financial Solutions

Public–Private Partnerships (PPPs), interconnected zones, renewable energy, energy efficiency.

Intersectoral Dialogue

Financial Innovation Labs (LABs) to promote dialogue with regulators, capital markets and financial sector stakeholders.

The Regional Group for the Development of Public-Private Partnerships (PPPs) is an initiative of ALIDE and the IDB, with the purpose of supporting the institutional strengthening of Public Development Banks (PDBs) in the Structuring and Financing of Public-Private Partnerships, responding to the infrastructure investment needs in the region and the potential that National Development Banks (NDBs) can bring to attract private financing for public-private partnerships that promote new investments in infrastructure.

The LATAM projects hub platform seeks to bring together the most relevant infrastructure and energy opportunities in the region open to private investment.

The IDB and ALIDE joined forces with Mexico's Project Hub (Banobras) and the Brazilian Development Bank (BNDES) to develop this regional platform that provides detailed and updated information to investors.

This initiative is expected to grow with the incorporation of other Latin American countries through the NDBs and PPP units focused on structuring PPP projects and concessions.

Where it is implemented

Goals

2MW biogas plant financed in the province of La Pampa

The goal of the program is to improve the efficiency and sustainability of energy production and use in Argentina. It is expected that the program increases SMEs´ investments in renewable energy ("ER") and energy efficiency ("EE"), through access to medium and long-term financing, thereby reducing greenhouse gas ("GHG") emissions and contributing to the country´s climate and energy goals.

In the long term, the cumulative results of the effective operation of the biomass, biogas, and energy efficiency sub-projects funded by our partners are expected to lead to more efficient and sustainable patterns of energy production and use.

Read MoreThe program is executed jointly by the Foreign Trade and Investment Bank (BICE), who leads the financing, and the IDB, who leads the technical cooperation.

This program uses Green Climate Fund (GCF) resources, along with co-financing from BICE and IDB, to develop and offer financial mechanisms designed to meet the specific needs of RE and EE projects and investments. We offer standard financing tools, such as loans that can be combined with instruments like the Energy Savings Insurance (ESI), to reduce perceived and real risks for project developers and SMEs, thereby helping to remove investment barriers.

The credit line encourages leverage of other sources of capital mainly through: (i) a minimum capital requirement in financed projects (e.g. from developers/SMEs as final beneficiaries of the sub-loans); and (ii) credit exposure limits per client.

Sector-specific uncertainties critically influence investment decisions in renewable energy and energy efficiency. For example, understanding how certain technologies work, the evolving regulatory framework for EE and RE, or the existence or volatility of a renewable energy resource. In this context, the demonstrative effect of public intervention becomes crucial to promote and attract private financing and create a cluster of energy efficiency and renewable energy investments backed by a carefully designed incentive structure. This includes financial incentives, guaranteed and third-party verified energy savings, risk-sharing mechanisms such as energy savings insurance, and international standards for ESG.

An additional challenge is overcoming the macroeconomic and operating challenges in the COVID-19 environment. At the same time, this program represents a vital opportunity to support Argentina and its SMEs in the low-carbon economic recovery phase.

Through year-end 2020, five sub-projects have been financed for the construction and operation of biogas and biomass plants to produce thermal and electric energy in different provinces of Argentina. Taken together, the total installed capacity is 10.5 MW with expected CO2e emissions reductions of 27,017 tCO2e per year. These sub-projects have leveraged USD 12.8 million of private financing from SMEs/third parties.

Read MorePipeline development activities continue. Many webinars and capacity building sessions have been carried out and are planned to build institutional capacity in EE and RE finance and investment opportunities. An electronic registry system has been designed and implementation continues at BICE to support sub-project evaluation and impact reporting. The enabling environment is being strengthened through, for example, policy dialogue activities that includes the creation and training of a new, cross-cutting sustainable finance team in the public sector led by the Ministry of Economy. In addition, various potential demand studies have been carried out, including a gender baseline study on financing female-led SMEs and participation of women in relevant engineering and operational activities in Argentina to promote greater market penetration.

In the long term, the cumulative results of the effective operation of the biomass, biogas, and energy efficiency sub-projects funded by our partners are expected to lead to more efficient and sustainable patterns of energy production and use in the Argentinean market.

https://www.bice.com.ar/productos/fondo-verde-para-el-clima/

Goals

The main objective is to build a tool for calculating GHG emissions and emission reductions within the scope of its operations portfolio. The tool, which will be integrated to the BDMG system, will assist the Bank's analysts to identify opportunities in terms of GHG reduction and contribute to a more specific assessment of issues related to the Sustainable Development Goals, especially objective 13, which concerns Climate Change.

Currently, BDMG has been involved in several activities related to promoting sustainability of its operations as well as its portfolio. However, measuring GHG emissions in financial institutions has been a challenge. The specificities of different types of projects prevent a clear account for emissions from the Bank’s perspectives. Therefore, BDMG worked on the development of indicators to estimate and monitor emissions, removals (or forest carbon stocks) and, if applicable, reductions in GHG emissions from the BDMG project financing portfolio.

The calculator will be able to provide real estimates with a customized approach based on indicators that are widely used in internationally recognized methodologies for calculating emissions, removals and emission reductions, such as the ABNT-NBR ISO 14.064, IPCC and GHG Protocol.

The calculator is expected to be fully tested and functioning by the end of 2021.

Goals

In alignment with BB’s Environmental and Social Responsibility Policy (PRSA) and Sustainability Plan, the bank works to continuously develop financial solutions and business models that promote the transition to an inclusive green economy. In this context, Banco do Brasil aims to raise funds through green, social or sustainability bonds and loans. BB presented its Sustainable Finance Framework, which was developed in accordance with the Green Bond Principles5 (GBP), the Social Bonds Principles6 (SBP), the Sustainability Bonds Guidelines (SBG) and the Green Loan Principles (GLP) and its guidelines (2018 version)

The financial sector plays an important role in the transition towards an Inclusive Green Economy, directing financial flows to sectors having more environmental and socially positive impacts and mitigating risks from its operations. As one of Latin America’s largest banks, Banco do Brasil aims to contribute decisively to Brazil’s transition towards a Green Economy. This Sustainable Finance Framework marks one of the bank’s efforts to diversify its funding possibilities to finance environmentally and socially positive projects.

Aligned with the global sustainable development agenda, Banco do Brasil enacted an action plan in 2005 promoting social and environmental responsibility. Until 2016, this plan was titled Agenda 21 BB in alignment with Agenda 21 Global, a commitment for this century that sought to promote actions that integrated economic growth, social justice and protection of the environment.

Read MoreWith the support of IDB, in 2017, the Banco do Brasil Sustainability Plan was updated for the sixth time and renamed Agenda 30 BB. This led to the recognition of Banco do Brasil as one of the most sustainable banks in the world, according to the Global 100 ranking of 2020 by Corporate Knights. BB was in the ninth position among the 100 Most Sustainable Corporations in the World, being the only financial company in Latin America to integrate the index and the Brazilian company most well placed.

Also, it has developed 2 different frameworks for the emissions of Green and Sustainable Development Goals (SDG) Bonds. With IDB support, the bank is now able to issue Bonds that could provide resources for projects related to renewable energy, energy efficiency, waste, poverty reduction, emission reductions among others.

https://www.bb.com.br/docs/portal/pub/CadernoAgenda30BB.pdf

https://www.corporateknights.com/reports/2019-global-100/2019-global-100-results-15481153/

Goals

Support BDMG to develop a model for structuring municipal PPPs in the state of Minas Gerais with a focus on public lighting in order to standardize and optimize the contracting process. It is expected that the model will be widely used within the state of MG, but with a view to its potential use in other states. For the development of the PPP structuring model, there were 4 components: (i) analysis of the sector's regulatory framework; (ii) proposal for a municipal regulatory framework for the PPP structuring model for public lighting; (iii) building of a membership model for small municipalities; (iv) Preparation of draft public notices and standard contracts.

Municipal PPPs have become one important alternative to provide public services to municipalities in Brazil, especially after Law 11.079/2004. However, PPPs have not reached its full potential due to lack of information on its processes and procedures, which prevent them to be developed and promoted by public entities. This project intends to standardize and optimize the contracting process as a way to facilitate the arrangements of PPPs, in this case for Public Lighting, and to find a model that can be used for scale up such opportunities.

As the project has come to its end, BDMG has now a set of tools to implement the model within the state of Minas Gerais. By the end of 2020, it is expected that the recent elected mayors from selected cities will be able to participate in the follow-up of this project.

Goals

BDMG has developed the BDMG Sustainability Bond Framework under which it intends to issue sustainability bond(s) and use the proceeds to finance and/or refinance, in whole or in part, loans to eligible projects or operations that generate clear social and environmental benefits in all economic sectors. The SDG Framework is the expansion of its previous Green Bond Framework which has also been supported.

Investments specifically towards sustainable development are still growing in Brazil and there is a need to increase their efficiency for social and green projects. The proceeds from these bonds will be used to finance or refinance projects or operations that have clear and significant socio-environmental impacts. The Bank will use the United Nations (UN) Sustainable Development Goals (SDGs) as a reference for selecting projects and impact activities.

The projects that are part of the current BDMG’s SDG portfolio or new aligned projects that become part of the institution's pipeline may be the basis for any sustainable issuance of Bank bonds. Eligible categories of projects that are now able to receive resources from Sustainable Bonds have been defined as well as the SDGs and their specific goals. The categories are:

Read More– Sustainable Agriculture and Sustainable Management of Living Natural Resources,

– Renewable Energy and Energy Efficiency,

– Sustainable Water and Wastewater Management,

– Clean Transportation,

– Pollution Prevention and Control,

– Access to Essential Services - Health,

– Access to Essential Services - Education,

– Socioeconomic Empowerment - Gender inclusion,

– Employment Generation - Micro and small enterprises,

– Affordable Basic Infrastructure - Inclusive and sustainable urbanization,

– Access to Essential Services - Economic recovery after disasters

https://www.bdmg.mg.gov.br/wp-content/uploads/2018/10/BDMG-Green-Bond-SPO_20180917.pdf

Goals

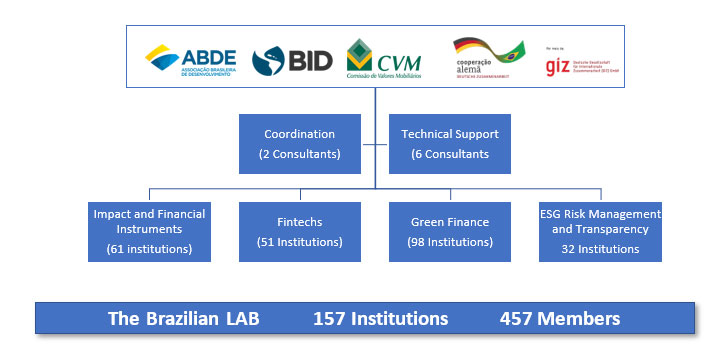

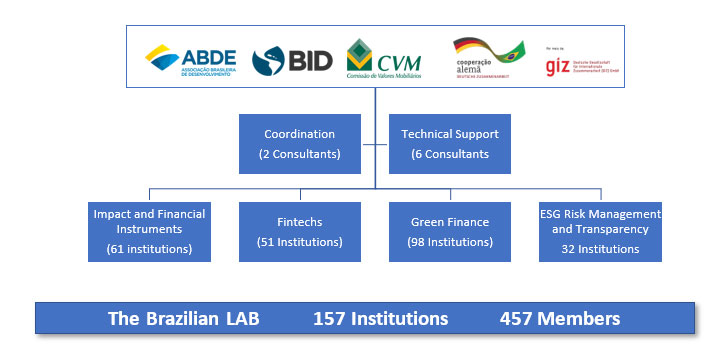

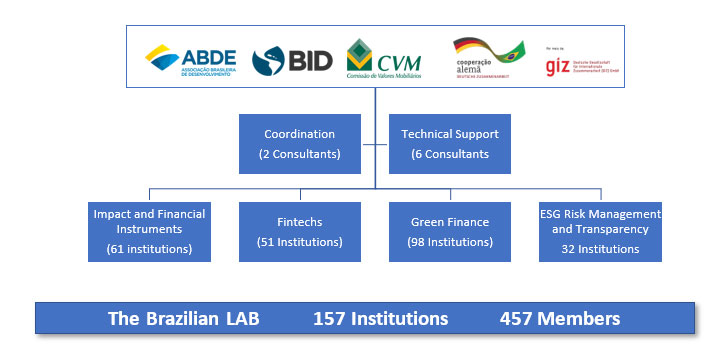

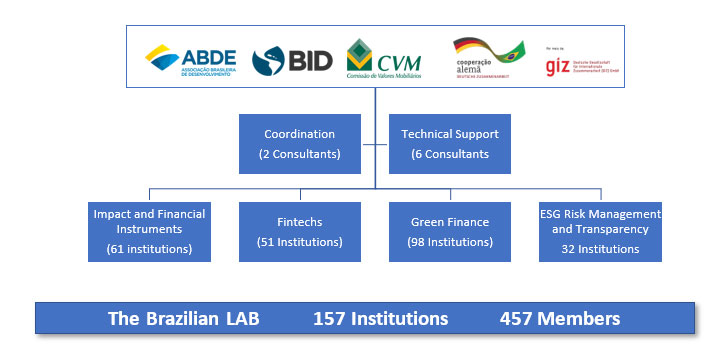

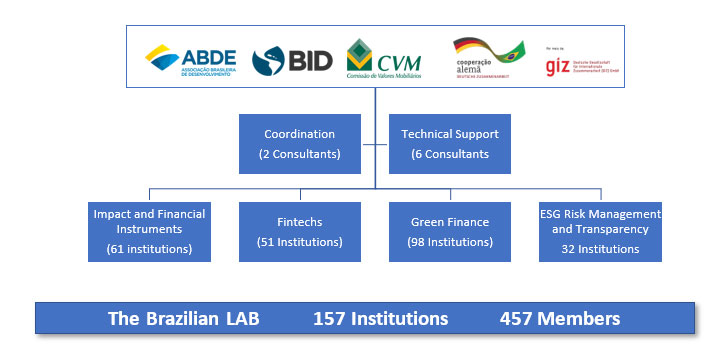

The Brazilian Lab for Financial Innovation (LAB) was created in 2017 to develop innovative sustainable finance instruments enabling public and private investments in activities contributing to achieve the country’s sustainable goals and commitments under the Paris Agreement. The LAB brings together various stakeholders of the capital and financial markets that would not otherwise engage with each other to identify how to address barriers to green investments. The LAB work is structured around 4 thematic working groups: Green Finance, Impact Investment, Fintech and Environmental, Social and Governance Risk Management and Transparency.

Energy efficiency and distributed renewable generation represent key areas for improving the long-term sustainability of industries and urban infrastructures to achieve the NDC. Nevertheless, investments in these areas are not flowing because of the following key outstanding financial and non-financial barriers such as gaps in financial regulations, gaps in investors/financiers’ awareness about the business opportunity and know-how to evaluate and finance energy efficiency and distributed renewable generation project, viability gaps due to the lack of adequate access to finance and scalable and replicable business models, and high up-front capital and transaction costs and technology performance risks perceptions.

The Brazilian Innovation LAB has brought together more than 457 group members from over 157 different local organizations from the financial, technology and energy sector that actively provide innovative financing solutions to leverage private resources for projects with social and/or environmental additionality and contribute to the fulfillment of the Brazilian goals associated SDGs and commitments to address the risks of climate change (under the Paris Agreement).

Read MoreThe project directly contributes to the financial and regulatory and policy framework and thus has a large transformational potential. The change is expected as knowledge sharing, and capacity building is facilitated through the participation of relevant actors including industry and financial actors and associations. These actors will be able to implement and translate developed instruments and policies in practice and thus create new DG and EE markets where the private sector can function on its own in the medium to long term.

https://labinovacaofinanceira.com/category/publicacoes/

https://labinovacaofinanceira.com/quem-somos/

Goals

The main objective is to build a tool for calculating GHG emissions and emission reductions within the scope of its operations portfolio. The tool, which will be integrated to the BDMG system, will assist the Bank's analysts to identify opportunities in terms of GHG reduction and contribute to a more specific assessment of issues related to the Sustainable Development Goals, especially objective 13, which concerns Climate Change.

Currently, BDMG has been involved in several activities related to promoting sustainability of its operations as well as its portfolio. However, measuring GHG emissions in financial institutions has been a challenge. The specificities of different types of projects prevent a clear account for emissions from the Bank’s perspectives. Therefore, BDMG worked on the development of indicators to estimate and monitor emissions, removals (or forest carbon stocks) and, if applicable, reductions in GHG emissions from the BDMG project financing portfolio.

The calculator will be able to provide real estimates with a customized approach based on indicators that are widely used in internationally recognized methodologies for calculating emissions, removals and emission reductions, such as the ABNT-NBR ISO 14.064, IPCC and GHG Protocol.

The calculator is expected to be fully tested and functioning by the end of 2021.

Goals

In alignment with BB’s Environmental and Social Responsibility Policy (PRSA) and Sustainability Plan, the bank works to continuously develop financial solutions and business models that promote the transition to an inclusive green economy. In this context, Banco do Brasil aims to raise funds through green, social or sustainability bonds and loans. BB presented its Sustainable Finance Framework, which was developed in accordance with the Green Bond Principles5 (GBP), the Social Bonds Principles6 (SBP), the Sustainability Bonds Guidelines (SBG) and the Green Loan Principles (GLP) and its guidelines (2018 version)

The financial sector plays an important role in the transition towards an Inclusive Green Economy, directing financial flows to sectors having more environmental and socially positive impacts and mitigating risks from its operations. As one of Latin America’s largest banks, Banco do Brasil aims to contribute decisively to Brazil’s transition towards a Green Economy. This Sustainable Finance Framework marks one of the bank’s efforts to diversify its funding possibilities to finance environmentally and socially positive projects.

Aligned with the global sustainable development agenda, Banco do Brasil enacted an action plan in 2005 promoting social and environmental responsibility. Until 2016, this plan was titled Agenda 21 BB in alignment with Agenda 21 Global, a commitment for this century that sought to promote actions that integrated economic growth, social justice and protection of the environment.

Read MoreWith the support of IDB, in 2017, the Banco do Brasil Sustainability Plan was updated for the sixth time and renamed Agenda 30 BB. This led to the recognition of Banco do Brasil as one of the most sustainable banks in the world, according to the Global 100 ranking of 2020 by Corporate Knights. BB was in the ninth position among the 100 Most Sustainable Corporations in the World, being the only financial company in Latin America to integrate the index and the Brazilian company most well placed.

Also, it has developed 2 different frameworks for the emissions of Green and Sustainable Development Goals (SDG) Bonds. With IDB support, the bank is now able to issue Bonds that could provide resources for projects related to renewable energy, energy efficiency, waste, poverty reduction, emission reductions among others.

https://www.bb.com.br/docs/portal/pub/CadernoAgenda30BB.pdf

https://www.corporateknights.com/reports/2019-global-100/2019-global-100-results-15481153/

Goals

The Brazilian Lab for Financial Innovation (LAB) was created in 2017 to develop innovative sustainable finance instruments enabling public and private investments in activities contributing to achieve the country’s sustainable goals and commitments under the Paris Agreement. The LAB brings together various stakeholders of the capital and financial markets that would not otherwise engage with each other to identify how to address barriers to green investments. The LAB work is structured around 4 thematic working groups: Green Finance, Impact Investment, Fintech and Environmental, Social and Governance Risk Management and Transparency.

Energy efficiency and distributed renewable generation represent key areas for improving the long-term sustainability of industries and urban infrastructures to achieve the NDC. Nevertheless, investments in these areas are not flowing because of the following key outstanding financial and non-financial barriers such as gaps in financial regulations, gaps in investors/financiers’ awareness about the business opportunity and know-how to evaluate and finance energy efficiency and distributed renewable generation project, viability gaps due to the lack of adequate access to finance and scalable and replicable business models, and high up-front capital and transaction costs and technology performance risks perceptions.

The Brazilian Innovation LAB has brought together more than 457 group members from over 157 different local organizations from the financial, technology and energy sector that actively provide innovative financing solutions to leverage private resources for projects with social and/or environmental additionality and contribute to the fulfillment of the Brazilian goals associated SDGs and commitments to address the risks of climate change (under the Paris Agreement).

Read MoreThe project directly contributes to the financial and regulatory and policy framework and thus has a large transformational potential. The change is expected as knowledge sharing, and capacity building is facilitated through the participation of relevant actors including industry and financial actors and associations. These actors will be able to implement and translate developed instruments and policies in practice and thus create new DG and EE markets where the private sector can function on its own in the medium to long term.

https://labinovacaofinanceira.com/category/publicacoes/

https://labinovacaofinanceira.com/quem-somos/

Goals

The main objective is to build a tool for calculating GHG emissions and emission reductions within the scope of its operations portfolio. The tool, which will be integrated to the BDMG system, will assist the Bank's analysts to identify opportunities in terms of GHG reduction and contribute to a more specific assessment of issues related to the Sustainable Development Goals, especially objective 13, which concerns Climate Change.

Currently, BDMG has been involved in several activities related to promoting sustainability of its operations as well as its portfolio. However, measuring GHG emissions in financial institutions has been a challenge. The specificities of different types of projects prevent a clear account for emissions from the Bank’s perspectives. Therefore, BDMG worked on the development of indicators to estimate and monitor emissions, removals (or forest carbon stocks) and, if applicable, reductions in GHG emissions from the BDMG project financing portfolio.

The calculator will be able to provide real estimates with a customized approach based on indicators that are widely used in internationally recognized methodologies for calculating emissions, removals and emission reductions, such as the ABNT-NBR ISO 14.064, IPCC and GHG Protocol.

The calculator is expected to be fully tested and functioning by the end of 2021.

Goals

In alignment with BB’s Environmental and Social Responsibility Policy (PRSA) and Sustainability Plan, the bank works to continuously develop financial solutions and business models that promote the transition to an inclusive green economy. In this context, Banco do Brasil aims to raise funds through green, social or sustainability bonds and loans. BB presented its Sustainable Finance Framework, which was developed in accordance with the Green Bond Principles5 (GBP), the Social Bonds Principles6 (SBP), the Sustainability Bonds Guidelines (SBG) and the Green Loan Principles (GLP) and its guidelines (2018 version)

The financial sector plays an important role in the transition towards an Inclusive Green Economy, directing financial flows to sectors having more environmental and socially positive impacts and mitigating risks from its operations. As one of Latin America’s largest banks, Banco do Brasil aims to contribute decisively to Brazil’s transition towards a Green Economy. This Sustainable Finance Framework marks one of the bank’s efforts to diversify its funding possibilities to finance environmentally and socially positive projects.

Aligned with the global sustainable development agenda, Banco do Brasil enacted an action plan in 2005 promoting social and environmental responsibility. Until 2016, this plan was titled Agenda 21 BB in alignment with Agenda 21 Global, a commitment for this century that sought to promote actions that integrated economic growth, social justice and protection of the environment.

Read MoreWith the support of IDB, in 2017, the Banco do Brasil Sustainability Plan was updated for the sixth time and renamed Agenda 30 BB. This led to the recognition of Banco do Brasil as one of the most sustainable banks in the world, according to the Global 100 ranking of 2020 by Corporate Knights. BB was in the ninth position among the 100 Most Sustainable Corporations in the World, being the only financial company in Latin America to integrate the index and the Brazilian company most well placed.

Also, it has developed 2 different frameworks for the emissions of Green and Sustainable Development Goals (SDG) Bonds. With IDB support, the bank is now able to issue Bonds that could provide resources for projects related to renewable energy, energy efficiency, waste, poverty reduction, emission reductions among others.

https://www.bb.com.br/docs/portal/pub/CadernoAgenda30BB.pdf

https://www.corporateknights.com/reports/2019-global-100/2019-global-100-results-15481153/

Goals

Evaluate the current innovation process within Fomento Paraná in order to identify potentialities and areas for improvement. In addition, it presented how Fomento Paraná is compared to similar financial institutions in terms of institutional development processes for innovation and management of strategic projects. Through the support of the IDB, its current institutional innovation and project management process will be updated according to proposed institutional improvements, within the scope of innovation and project management.

There were several factors that led the Fomento Paraná team to identify the theme as not only to promote green finance, but to all other ongoing projects in the institution. First, with the institution's growth in recent years, teams were invited to interact with a much larger number of variables. The new reality imposed the need for continuous contact with dozens of sources of funding, hundreds of operational partnerships and thousands, and thousands, of customers. That is, all this complexity would certainly benefit from the introduction of new instruments for governance used in the most modern project offices. However, another characteristic striking emerged in this escalation of the institution: the need to innovate.

All processes concerning the management of innovation within Fomento PR have been identified and described. It has indicated the need of a Performance Office that should be working on processes, projects and innovation. This is supposed to be implemented in the next phase of the partnership and related KPIs will be provided as a way to assess the results from the organization.

Goals

The Brazilian Lab for Financial Innovation (LAB) was created in 2017 to develop innovative sustainable finance instruments enabling public and private investments in activities contributing to achieve the country’s sustainable goals and commitments under the Paris Agreement. The LAB brings together various stakeholders of the capital and financial markets that would not otherwise engage with each other to identify how to address barriers to green investments. The LAB work is structured around 4 thematic working groups: Green Finance, Impact Investment, Fintech and Environmental, Social and Governance Risk Management and Transparency.

Energy efficiency and distributed renewable generation represent key areas for improving the long-term sustainability of industries and urban infrastructures to achieve the NDC. Nevertheless, investments in these areas are not flowing because of the following key outstanding financial and non-financial barriers such as gaps in financial regulations, gaps in investors/financiers’ awareness about the business opportunity and know-how to evaluate and finance energy efficiency and distributed renewable generation project, viability gaps due to the lack of adequate access to finance and scalable and replicable business models, and high up-front capital and transaction costs and technology performance risks perceptions.

The Brazilian Innovation LAB has brought together more than 457 group members from over 157 different local organizations from the financial, technology and energy sector that actively provide innovative financing solutions to leverage private resources for projects with social and/or environmental additionality and contribute to the fulfillment of the Brazilian goals associated SDGs and commitments to address the risks of climate change (under the Paris Agreement).

Read MoreThe project directly contributes to the financial and regulatory and policy framework and thus has a large transformational potential. The change is expected as knowledge sharing, and capacity building is facilitated through the participation of relevant actors including industry and financial actors and associations. These actors will be able to implement and translate developed instruments and policies in practice and thus create new DG and EE markets where the private sector can function on its own in the medium to long term.

https://labinovacaofinanceira.com/category/publicacoes/

https://labinovacaofinanceira.com/quem-somos/

Goals

The main objective is to build a tool for calculating GHG emissions and emission reductions within the scope of its operations portfolio. The tool, which will be integrated to the BDMG system, will assist the Bank's analysts to identify opportunities in terms of GHG reduction and contribute to a more specific assessment of issues related to the Sustainable Development Goals, especially objective 13, which concerns Climate Change.

Currently, BDMG has been involved in several activities related to promoting sustainability of its operations as well as its portfolio. However, measuring GHG emissions in financial institutions has been a challenge. The specificities of different types of projects prevent a clear account for emissions from the Bank’s perspectives. Therefore, BDMG worked on the development of indicators to estimate and monitor emissions, removals (or forest carbon stocks) and, if applicable, reductions in GHG emissions from the BDMG project financing portfolio.

The calculator will be able to provide real estimates with a customized approach based on indicators that are widely used in internationally recognized methodologies for calculating emissions, removals and emission reductions, such as the ABNT-NBR ISO 14.064, IPCC and GHG Protocol.

The calculator is expected to be fully tested and functioning by the end of 2021.

Goals

The Brazilian Lab for Financial Innovation (LAB) was created in 2017 to develop innovative sustainable finance instruments enabling public and private investments in activities contributing to achieve the country’s sustainable goals and commitments under the Paris Agreement. The LAB brings together various stakeholders of the capital and financial markets that would not otherwise engage with each other to identify how to address barriers to green investments. The LAB work is structured around 4 thematic working groups: Green Finance, Impact Investment, Fintech and Environmental, Social and Governance Risk Management and Transparency.

Energy efficiency and distributed renewable generation represent key areas for improving the long-term sustainability of industries and urban infrastructures to achieve the NDC. Nevertheless, investments in these areas are not flowing because of the following key outstanding financial and non-financial barriers such as gaps in financial regulations, gaps in investors/financiers’ awareness about the business opportunity and know-how to evaluate and finance energy efficiency and distributed renewable generation project, viability gaps due to the lack of adequate access to finance and scalable and replicable business models, and high up-front capital and transaction costs and technology performance risks perceptions.

The Brazilian Innovation LAB has brought together more than 457 group members from over 157 different local organizations from the financial, technology and energy sector that actively provide innovative financing solutions to leverage private resources for projects with social and/or environmental additionality and contribute to the fulfillment of the Brazilian goals associated SDGs and commitments to address the risks of climate change (under the Paris Agreement).

Read MoreThe project directly contributes to the financial and regulatory and policy framework and thus has a large transformational potential. The change is expected as knowledge sharing, and capacity building is facilitated through the participation of relevant actors including industry and financial actors and associations. These actors will be able to implement and translate developed instruments and policies in practice and thus create new DG and EE markets where the private sector can function on its own in the medium to long term.

https://labinovacaofinanceira.com/category/publicacoes/

https://labinovacaofinanceira.com/quem-somos/

Goals

The main objective is to build a tool for calculating GHG emissions and emission reductions within the scope of its operations portfolio. The tool, which will be integrated to the BDMG system, will assist the Bank's analysts to identify opportunities in terms of GHG reduction and contribute to a more specific assessment of issues related to the Sustainable Development Goals, especially objective 13, which concerns Climate Change.

Currently, BDMG has been involved in several activities related to promoting sustainability of its operations as well as its portfolio. However, measuring GHG emissions in financial institutions has been a challenge. The specificities of different types of projects prevent a clear account for emissions from the Bank’s perspectives. Therefore, BDMG worked on the development of indicators to estimate and monitor emissions, removals (or forest carbon stocks) and, if applicable, reductions in GHG emissions from the BDMG project financing portfolio.

The calculator will be able to provide real estimates with a customized approach based on indicators that are widely used in internationally recognized methodologies for calculating emissions, removals and emission reductions, such as the ABNT-NBR ISO 14.064, IPCC and GHG Protocol.

The calculator is expected to be fully tested and functioning by the end of 2021.

Goals

The main objective is to build a tool for calculating GHG emissions and emission reductions within the scope of its operations portfolio. The tool, which will be integrated to the BDMG system, will assist the Bank's analysts to identify opportunities in terms of GHG reduction and contribute to a more specific assessment of issues related to the Sustainable Development Goals, especially objective 13, which concerns Climate Change.

Currently, BDMG has been involved in several activities related to promoting sustainability of its operations as well as its portfolio. However, measuring GHG emissions in financial institutions has been a challenge. The specificities of different types of projects prevent a clear account for emissions from the Bank’s perspectives. Therefore, BDMG worked on the development of indicators to estimate and monitor emissions, removals (or forest carbon stocks) and, if applicable, reductions in GHG emissions from the BDMG project financing portfolio.

The calculator will be able to provide real estimates with a customized approach based on indicators that are widely used in internationally recognized methodologies for calculating emissions, removals and emission reductions, such as the ABNT-NBR ISO 14.064, IPCC and GHG Protocol.

The calculator is expected to be fully tested and functioning by the end of 2021.

Goals

The Brazilian Lab for Financial Innovation (LAB) was created in 2017 to develop innovative sustainable finance instruments enabling public and private investments in activities contributing to achieve the country’s sustainable goals and commitments under the Paris Agreement. The LAB brings together various stakeholders of the capital and financial markets that would not otherwise engage with each other to identify how to address barriers to green investments. The LAB work is structured around 4 thematic working groups: Green Finance, Impact Investment, Fintech and Environmental, Social and Governance Risk Management and Transparency.

Energy efficiency and distributed renewable generation represent key areas for improving the long-term sustainability of industries and urban infrastructures to achieve the NDC. Nevertheless, investments in these areas are not flowing because of the following key outstanding financial and non-financial barriers such as gaps in financial regulations, gaps in investors/financiers’ awareness about the business opportunity and know-how to evaluate and finance energy efficiency and distributed renewable generation project, viability gaps due to the lack of adequate access to finance and scalable and replicable business models, and high up-front capital and transaction costs and technology performance risks perceptions.

The Brazilian Innovation LAB has brought together more than 457 group members from over 157 different local organizations from the financial, technology and energy sector that actively provide innovative financing solutions to leverage private resources for projects with social and/or environmental additionality and contribute to the fulfillment of the Brazilian goals associated SDGs and commitments to address the risks of climate change (under the Paris Agreement).

Read MoreThe project directly contributes to the financial and regulatory and policy framework and thus has a large transformational potential. The change is expected as knowledge sharing, and capacity building is facilitated through the participation of relevant actors including industry and financial actors and associations. These actors will be able to implement and translate developed instruments and policies in practice and thus create new DG and EE markets where the private sector can function on its own in the medium to long term.

https://labinovacaofinanceira.com/category/publicacoes/

https://labinovacaofinanceira.com/quem-somos/

The Government of Chile is promoting the development of strategies at the national scale to promote investments in Public-Private Partnerships and green private investments, through dialogue tables between the public and the private sector (the “Green Agreement”).

CORFO will be developing and implementing innovative financial instruments and technical assistance to be deployed through Chile’s first-tier, local, financial institutions to promote private investments in low-carbon projects including renewable energy, energy efficiency and sustainable transport measures.

Goals

Support Colombia's actions to improve access to energy in remote zones and promote access to clean energy sources, while reducing greenhouse gas (GHG) emissions by testing an innovative financing model for renewable energy projects for non-interconnected zones (ZNI).

The main challenges of the program are related to sustainability issues, technical and logistical problems for the implementation of new technologies, and precise information to access the program.

Read More

• 52% of the Colombian territory is located in Non-Interconnected Zones, where 1,900,000 people live (IPSE). Therefore, unconventional renewable power generation projects will tend to be small and disseminated. The operation and maintenance of the financed projects should integrate a long-term sustainability component that guarantees the service provision in the communities involved.

• In the projects financed and that include hybrid solutions such as Diesel-Solar-photovoltaic, there have been technical difficulties in the synchronization of the systems and languages. It will require the procurement and analysis of new indicators, protocols, new tracking and monitoring systems that allow the developers of these solutions to overcome these barriers.

• The dates of the operational start have been delayed due to the difficulties of access, communication and transportation of materials to the areas.

• Both for financial intermediaries and for the companies developing the projects, it is not clear the type of information they must report to access to the program resources; therefore, it is necessary to develop a dissemination strategy of the required indicators.

Local financial institutions in Colombia are interested in penetrating deeply into the renewable energy market. However, banks need to strengthen capacities in green financing and financing of renewable energy projects. Some of the financial institutions must start by establishing basic conceptual principles and work on the development and implementation of an environmental and social risk management system. The project has been developing capabilities in: (i) the design and implementation of a comprehensive capacity generation program in structured financing of renewable energies that includes strategic advice, generation and implementation of specialized technical, financial and legal tools and training; and (ii) a guide for creating an environmental and social risk management system available to all financial institutions interested in implementing it.

Read MoreThe activities derived from technical cooperation have strengthened the relationship between Bancóldex and the first-tier banks as the latter acquired more in-depth knowledge of the weaknesses and skills that must be strengthened to successfully finance renewable energy and energy efficient investment projects.

From the size and location of the projects that have been financed with program resources, the expected impact compared to GW generated with renewable energy and the reduction of CO2 tons will be moderate. However, the number of beneficiaries who will have access to the electric power service in remote areas, the increase in hours of service and its quality have been significantly impacted.

On the other hand, through the training of local financial institutions in the evaluation of project financing and the support in the procedures implementation for evaluating environmental and social risks, it is expected to increase the potential for energy financing in not interconnected areas.

Regarding the national context, Colombia register a high average index of medium-high electrical coverage, however, two thirds of the country's territory are not covered by the national interconnected system (SIN). The limited energy services available in ZNI are generated under a highly subsidized business model based on traditional technologies.

In order to increase access to energy, reduce operating costs, and promote cleaner energy production in not connected zones, the Colombian government has undertaken a series of initiatives to promote private sector investments in renewable energy generation projects for those areas. Although the program has a particular focus on the second tier (Bancóldex), it is expected that first-level private financial institutions will play a fundamental role in promoting sustainability and mitigating climate change, given their ability to promote financial incentives, manage national funds leverage international financing.

Goals

The objective of the project is to support the design of a strategy in order to mitigate and reduce the main barriers and risks associated with the financing of Energy Efficiency (EE) projects in LED street lighting, and to create market conditions that stimulate demand for this type of investment projects, by municipalities and the private sector.

In Colombia a high potential in energy efficiency was identified, but it was also identified that there were barriers to the implementation of this type of investment, given the lack of knowledge and uncertainty around them, because, despite the successful cases worldwide, in Colombia it is a new technology and seeks to serve a segment that does not invest in environmental projects, nor does it have extensive knowledge.

Read MoreThe main challenge identified are the difficulties that FINDETER has had in implementing the project in the pilot municipalities and having the commitment of the local authorities to advance in the implementation of the Program's activities, which has translated in delays during the implementation process of the Technical cooperation.

A technical, legal, and financial structuring methodology was defined for public lighting projects in Colombia. The different business models were addressed in order to overcome the technical and legal obstacles and the risks related to the execution of this type of project. Thus, the different business models were established to carry out the modernization and improvement in terms of EE of the Public Lighting Service, according to the different provision schemes, in the Municipalities of Colombia.

The financial mechanisms that best fit FINDETER's products and services were identified and analyzed, in order to establish, socialize and support their implementation to promote these projects. Different financial mechanisms aimed at the correct structuring of EE projects in Public Lighting were made available. These mechanisms will help project developers, municipalities and concessionaires to generate a framework under which these projects can be developed and financed. In addition, they will provide FINDETER with the necessary tools to potentiate these projects, which will have an impact in accordance with the national and institutional policy defined in environmental, social and economic terms.

Read MoreThe project is under execution so there are still no final results from its implementation.

The CT was designed based on a diagnosis on energy consumption in Colombia. The energy consumption of public lighting in Colombia accounted for approximately 3% of the country's consumption, which generated around 214,228 tons of carbon dioxide, since most of the lamps, approximately 70%, used at high pressure sodium vapor technology (HPSV). This energy generated high costs, approximately US $ 290 million a year, the majority of which were covered by the municipalities, who are responsible for public lighting.

This project is part of the National Development Plan: 2014 - 2018 of the National Government, which includes among its strategies, Green Growth in different sectors with special emphasis on “Consolidating mining-energy development for regional equity and Expanding coverage and quality electric power”. In line with this strategy, the Government proposes public lighting as "a non-domiciliary public service, inherent to the electric energy service, for which the Districts and Municipalities are directly responsible, within criteria set by the National Government in terms of coverage, quality, energy and economic efficiency”.

On the other hand, at the COP21 in Paris in 2015, Colombia agreed to reduce its greenhouse gas (GHG) emissions by 20% by 2030.

https://www.iadb.org/es/project/CO-T1423

https://www.iadb.org/Document.cfm?id=EZSHARE-2056220512-3270

Goals

The objective of the project is to support the design of a strategy in order to mitigate and reduce the main barriers and risks associated with the financing of Energy Efficiency (EE) projects in LED street lighting, and to create market conditions that stimulate demand for this type of investment projects, by municipalities and the private sector.

In Colombia a high potential in energy efficiency was identified, but it was also identified that there were barriers to the implementation of this type of investment, given the lack of knowledge and uncertainty around them, because, despite the successful cases worldwide, in Colombia it is a new technology and seeks to serve a segment that does not invest in environmental projects, nor does it have extensive knowledge.

Read MoreThe main challenge identified are the difficulties that FINDETER has had in implementing the project in the pilot municipalities and having the commitment of the local authorities to advance in the implementation of the Program's activities, which has translated in delays during the implementation process of the Technical cooperation.

A technical, legal, and financial structuring methodology was defined for public lighting projects in Colombia. The different business models were addressed in order to overcome the technical and legal obstacles and the risks related to the execution of this type of project. Thus, the different business models were established to carry out the modernization and improvement in terms of EE of the Public Lighting Service, according to the different provision schemes, in the Municipalities of Colombia.

The financial mechanisms that best fit FINDETER's products and services were identified and analyzed, in order to establish, socialize and support their implementation to promote these projects. Different financial mechanisms aimed at the correct structuring of EE projects in Public Lighting were made available. These mechanisms will help project developers, municipalities and concessionaires to generate a framework under which these projects can be developed and financed. In addition, they will provide FINDETER with the necessary tools to potentiate these projects, which will have an impact in accordance with the national and institutional policy defined in environmental, social and economic terms.

Read MoreThe project is under execution so there are still no final results from its implementation.

The CT was designed based on a diagnosis on energy consumption in Colombia. The energy consumption of public lighting in Colombia accounted for approximately 3% of the country's consumption, which generated around 214,228 tons of carbon dioxide, since most of the lamps, approximately 70%, used at high pressure sodium vapor technology (HPSV). This energy generated high costs, approximately US $ 290 million a year, the majority of which were covered by the municipalities, who are responsible for public lighting.

This project is part of the National Development Plan: 2014 - 2018 of the National Government, which includes among its strategies, Green Growth in different sectors with special emphasis on “Consolidating mining-energy development for regional equity and Expanding coverage and quality electric power”. In line with this strategy, the Government proposes public lighting as "a non-domiciliary public service, inherent to the electric energy service, for which the Districts and Municipalities are directly responsible, within criteria set by the National Government in terms of coverage, quality, energy and economic efficiency”.

On the other hand, at the COP21 in Paris in 2015, Colombia agreed to reduce its greenhouse gas (GHG) emissions by 20% by 2030.

https://www.iadb.org/es/project/CO-T1423

https://www.iadb.org/Document.cfm?id=EZSHARE-2056220512-3270

Goals

Beginning of roof installation of 126 solar panels (500W each) at Zona Cero restaurant. In addition, the company is investing in 9 efficient air conditioners for the interior.

Remarks from IDB Representative in El Salvador, César Falconi, at the Event Launch of the Microsite for the Energy Efficiency Credit Line.

The goal of the program is to promote energy efficiency (EE) investments for small- and medium-sized enterprises (SMEs) and improve their access to EE finance in El Salvador. As these investments grow, they will increasingly contribute to the reduction of greenhouse gas ("GHG") emissions and to the country´s climate and energy goals.

The direct benefits of the EE financing line are targeted at SMEs who wish to finance equipment and technology modernization projects that will increase their productivity and overall competitiveness, while generating energy and cost savings, reducing the use of fossil fuels, and generating a positive impact on the environment.

The program financing and technical cooperation is executed by the Development Bank of the Republic of El Salvador (BANDESAL), with support from the Inter-American Development Bank (IDB) and the Green Climate Fund (GCF). GCF resources have been combined with co-financing from BANDESAL and IDB, to develop and offer an EE financing line including mechanisms designed specifically to meet the needs of SMEs and EE projects and investments.

Read MoreA total of USD 40 million is available to lend to SMEs in the country through BANDESAL’s network of Local Financial Institutions (LFIs).

Loans are offered through the EE financing line, which are available with medium- and long-term tenors and competitive interest rates. There are two financing modalities, carried out in collaboration with endorsed suppliers and other partners: the standard model and the Energy Savings Insurance (ESI) model. The standard model validates energy savings through an international company, ensuring that operational efficiencies and optimization are realized. The ESI model validates energy savings through an international company, and in addition, provides insurance to the SME/project developer that will compensate for any gap between the energy savings promised by the supplier and the actual savings obtained, thus providing secured savings.

This combination of financial and non-financial instruments and risk-sharing mechanisms reduces the perceived and real risks for SMEs/project developers and LFIs, thereby helping to remove investment barriers and increasing sustainable energy investments for businesses.

In addition to access to credit, market barriers are a constraint to the development of the sustainable investments and finance industry. Specifically, there is a lack of knowledge and understanding of how certain technologies work among LFIs and SMEs, along with the risks and returns of these projects. In addition, there is lack of confidence by investors and their financiers in the ability of EE service and technology providers to deliver on the agreed-upon energy savings. This Program is addressing these barriers and the real and perceived risks in order to build confidence in the market for these types of investments.

There are also sector-specific uncertainties and changes such as the evolving regulatory framework for EE. Therefore, the demonstration effect of public intervention becomes crucial to promote and attract private financing and thereby increase EE investments among SMEs.

An additional challenge is overcoming the macroeconomic and operating challenges in the COVID-19 environment. At the same time, this program represents a key opportunity to support El Salvador and its SMEs in a low-carbon, resilient economic recovery.

Through June 30, 2021, two sub-projects have been financed for investments in solar PV and efficient air conditioners. Taken together, the total expected estimated CO2e emissions reductions is 6,744 tCO2e per year.

Read MoreAs a result of continuous business development and pipeline generation activities, including working with endorsed EE suppliers and other partners, BANDESAL has developed a strong pipeline of potential EE sub-loans to SMEs through its network of LFIs. This includes projects for which funds have already been committed (but not yet disbursed). The majority of pipeline projects are for solar PV investments.

BANDESAL launched its digital microsite for the EE credit line. The aim is to both publicize information on the characteristics, eligible technologies, benefits, and loan conditions as well as to provide a platform that brings together different stakeholders including SMEs, suppliers, and LFIs. It is also expected that the microsite will help increase the number of loans granted under the EE credit line.

An electronic registry system has also been designed at BANDESAL to support project evaluation and impact reporting. Implementation continues and more improvements and enhancements will be made to it based on the experience to date.

https://www.greenclimate.fund/project/fp009

Goals

In collaboration with the LAB, aims to initiate a dialogue with key stakeholders of the energy sector and especially seeking to develop financing initiatives for distributed generation. This project consists of two stages: i) development of a workshop that involves governmental, financial, multilateral institutions, technology providers and other entities that participate in the development of distributed generation; ii) roadmap development to promote distributed generation that will be led by NAFIN and BANCOMEXT with the help of a specialist consultant in the sector.

During the workshop, the role of development banks in accelerating private investment in the development of distributed generation projects in Mexico was analyzed. Although this type of project has aroused the interest of banks, the financing programs that currently seek to provide technical and performance certainty in the facilities have not been massively deployed.

During the roadmap design, the conclusions of the workshop should be integrated and a strategy to promote the massification of distributed generation projects in the different sectors of the country should be implemented.

During the workshop held in November 2019, it was possible to bring together key stakeholder of distributed generation in order to give their perspective in terms of the opportunities that this type of projects introduce and positive impact in terms of cost reductions for firms, institutions and families and of climate change mitigation.

Read MoreSeveral specialized financial institutions in the sector could be identified that, together with NAFIN and BANCOMEXT, can establish the foundations to innovate financial products that help to massively deploy distributed generation, particularly solar energy due to its easy implementation.

In the workshop the technology maturity and the advances achieved in Mexico were revealed. Nonetheless, the development of financing strategies should be encouraged massive implementation of projects.

During the development of the workshop, the main barriers and challenges that arise in the sustainable energy sector through distributed generation were deliberated, assisting as a design guideline for the sector promotion roadmap.

Goals

This project aims to develop a market study on the potential of implementing energy efficiency and renewable energy projects in the tourism sector, specifically in hotels in the country. The scope of the study is national and should consider both tourist and business destinations and technologies with potential in terms of profitability and understanding of it by the sector.

According to the results obtained, It will be possible to provide elements to BANCOMEXT to structure a green financing line that promotes sustainability in hotels in Mexico.

The second most important fixed cost of the hotel sector is energy, one of the main challenges of this project was to determine the technologies that allow to create positive impacts in the mitigation of greenhouse gases while economically efficient and strongly linked to the main energy costs of a hotel.

The other great challenge of the study was to identify the market size of hotels in Mexico that could successfully implement sustainable energy projects based on their various attributes: category, types of destination, number of rooms, among others.

The development of the project was carried out in collaboration with the consulting firm Deloitte, which conducted interviews with key actors in the sector, on both the supply and demand sides. The result of this study was an understanding of which hotel segment is most favorable for sustainable energy financing.

Read MoreOn the other hand, it was essential to know the technological offer and its feasibility to the hotel sector to determine five types of equipment to promote trough financing offered by BANCOMEXT. These technologies were solar panels for electricity generation and water heating; air conditioning systems; lightning; and micro-cogeneration systems. BANCOMEXT and the IDB have continued to structure possible financing lines that promote the mitigation of climate change in a sector that has great potential to reduce the impact on the planet.

Goals

The Financial Innovation Laboratory (LAB Mexico) is a multi-sectoral and institutional dialogue space that promotes debate and the exchange of experiences in green finance, with the participation of the public and private sectors in the generation of financial innovations that support sustainable development of Mexico.

LAB Mexico is a project initiated by the Association of Banks of Mexico (ABM), the BMV Advisory Council on Green Finance, the German Corporation for International Cooperation (GIZ) and the Inter-American Development Bank (IDB).

Key challenges are:

• Create a shared and transparent agenda of initiatives that support the integration and coordination of similar projects, avoiding efforts dispersion.

• To be recognized as a space that encourages debate and innovation in the field of green finance.

• Identifying existing best practices and promote them instead of creating new ones, avoiding duplications that dilute their impact.

• Awaken interest in private and public institutions in joining this Laboratory, contributing with knowledge or resources to accelerate its impact.

• Identify bottlenecks to private investment in green financing, particularly energy, transport, agriculture and water, among others.

• Design innovative financial instruments to promote climate investments.

The LAB is organized into three working groups (GT) that help to structure the projects according to their mission: (1) Green Banks (2) Sustainable Investments and (3) Sectoral Initiatives.

Read MoreRegarding Green Banks, it has been possible to promote a culture of climate risks through the provision of workshops, where banks have actively participated.

From the sectoral point of view, two initiatives have been structured: sustainable transport and distributed generation. This seeks to promote the financing agenda in these two sectors that have remarkable opportunity for development.

With strong convening power, development banking is a major player in this initiative, supporting sectoral efforts in climate finance. One of the activities with which LAB seeks to generate value is the coordination and integration of initiatives of the main actors in climate finance, avoiding duplication and dispersion of efforts. LAB will continue adding more institutions that contribute to the development of Green finance.

Goals

The Financial Innovation Laboratory (LAB Mexico) is a multi-sectoral and institutional dialogue space that promotes debate and the exchange of experiences in green finance, with the participation of the public and private sectors in the generation of financial innovations that support sustainable development of Mexico.

LAB Mexico is a project initiated by the Association of Banks of Mexico (ABM), the BMV Advisory Council on Green Finance, the German Corporation for International Cooperation (GIZ) and the Inter-American Development Bank (IDB).

Key challenges are:

• Create a shared and transparent agenda of initiatives that support the integration and coordination of similar projects, avoiding efforts dispersion.

• To be recognized as a space that encourages debate and innovation in the field of green finance.

• Identifying existing best practices and promote them instead of creating new ones, avoiding duplications that dilute their impact.

• Awaken interest in private and public institutions in joining this Laboratory, contributing with knowledge or resources to accelerate its impact.

• Identify bottlenecks to private investment in green financing, particularly energy, transport, agriculture and water, among others.

• Design innovative financial instruments to promote climate investments.

The LAB is organized into three working groups (GT) that help to structure the projects according to their mission: (1) Green Banks (2) Sustainable Investments and (3) Sectoral Initiatives.

Read MoreRegarding Green Banks, it has been possible to promote a culture of climate risks through the provision of workshops, where banks have actively participated.

From the sectoral point of view, two initiatives have been structured: sustainable transport and distributed generation. This seeks to promote the financing agenda in these two sectors that have remarkable opportunity for development.

With strong convening power, development banking is a major player in this initiative, supporting sectoral efforts in climate finance. One of the activities with which LAB seeks to generate value is the coordination and integration of initiatives of the main actors in climate finance, avoiding duplication and dispersion of efforts. LAB will continue adding more institutions that contribute to the development of Green finance.

Goals

This project aims to develop a market study on the potential of implementing energy efficiency and renewable energy projects in the tourism sector, specifically in hotels in the country. The scope of the study is national and should consider both tourist and business destinations and technologies with potential in terms of profitability and understanding of it by the sector.

According to the results obtained, It will be possible to provide elements to BANCOMEXT to structure a green financing line that promotes sustainability in hotels in Mexico.

The second most important fixed cost of the hotel sector is energy, one of the main challenges of this project was to determine the technologies that allow to create positive impacts in the mitigation of greenhouse gases while economically efficient and strongly linked to the main energy costs of a hotel.

The other great challenge of the study was to identify the market size of hotels in Mexico that could successfully implement sustainable energy projects based on their various attributes: category, types of destination, number of rooms, among others.

The development of the project was carried out in collaboration with the consulting firm Deloitte, which conducted interviews with key actors in the sector, on both the supply and demand sides. The result of this study was an understanding of which hotel segment is most favorable for sustainable energy financing.

Read MoreOn the other hand, it was essential to know the technological offer and its feasibility to the hotel sector to determine five types of equipment to promote trough financing offered by BANCOMEXT. These technologies were solar panels for electricity generation and water heating; air conditioning systems; lightning; and micro-cogeneration systems. BANCOMEXT and the IDB have continued to structure possible financing lines that promote the mitigation of climate change in a sector that has great potential to reduce the impact on the planet.

Goals

Develop a methodology and assessment tool for housing urbanization projects with sustainability criteria and establish the elements to differentiate from “business as usual” urbanization, regarding the integration of national and international best practices, and relative to the regulatory framework in force in Mexico.

The project seeks to promote the development of green urbanization in the country's housing developments and to avoid urban infrastructure without sustainable criteria.

Aware of the challenges of developing sustainable housing infrastructure, SHF carried out a series of studies during 2016 in order to identify the main challenges facing housing developers.

The complexity of housing developers to carry out urbanization tasks for housing was identified, particularly when seeking to integrate sustainability criteria into developments. Municipalities are responsible for urbanization, but due to precarious financial situation of many, developers assume the task and need additional capital efforts in order to ensure minimum operating conditions for their projects.

The tool design focused on accounting energy and water efficiencies and, therefore, Greenhouse Gas (GHG) emissions associated, as well as the impacts from savings and access to equipment and infrastructure under the sustainable modality.

Read MoreAs part of the methodological process, the objectives contained in the UN 2030 Agenda on Sustainable Development prepared during 2015 were integrated, particularly those related to water management, resilience and inclusion and security of population.

As a result of this methodological approach and the tool that automates modeling, the central benefit for SHF is the quantification of the economic benefit, considering additionality, transparency, traceability and ownership of certificates.

The development of clear and structured criteria in urban projects makes it possible to clearly define the economic, social and environmental impact, enabling the mobilization of actions for sustainable investments in this sector.

Goals

The Financial Innovation Laboratory (LAB Mexico) is a multi-sectoral and institutional dialogue space that promotes debate and the exchange of experiences in green finance, with the participation of the public and private sectors in the generation of financial innovations that support sustainable development of Mexico.

LAB Mexico is a project initiated by the Association of Banks of Mexico (ABM), the BMV Advisory Council on Green Finance, the German Corporation for International Cooperation (GIZ) and the Inter-American Development Bank (IDB).

Key challenges are:

• Create a shared and transparent agenda of initiatives that support the integration and coordination of similar projects, avoiding efforts dispersion.

• To be recognized as a space that encourages debate and innovation in the field of green finance.

• Identifying existing best practices and promote them instead of creating new ones, avoiding duplications that dilute their impact.

• Awaken interest in private and public institutions in joining this Laboratory, contributing with knowledge or resources to accelerate its impact.

• Identify bottlenecks to private investment in green financing, particularly energy, transport, agriculture and water, among others.

• Design innovative financial instruments to promote climate investments.

The LAB is organized into three working groups (GT) that help to structure the projects according to their mission: (1) Green Banks (2) Sustainable Investments and (3) Sectoral Initiatives.

Read MoreRegarding Green Banks, it has been possible to promote a culture of climate risks through the provision of workshops, where banks have actively participated.

From the sectoral point of view, two initiatives have been structured: sustainable transport and distributed generation. This seeks to promote the financing agenda in these two sectors that have remarkable opportunity for development.

With strong convening power, development banking is a major player in this initiative, supporting sectoral efforts in climate finance. One of the activities with which LAB seeks to generate value is the coordination and integration of initiatives of the main actors in climate finance, avoiding duplication and dispersion of efforts. LAB will continue adding more institutions that contribute to the development of Green finance.

Goals

Develop a methodology and assessment tool for housing urbanization projects with sustainability criteria and establish the elements to differentiate from “business as usual” urbanization, regarding the integration of national and international best practices, and relative to the regulatory framework in force in Mexico.

The project seeks to promote the development of green urbanization in the country's housing developments and to avoid urban infrastructure without sustainable criteria.

Aware of the challenges of developing sustainable housing infrastructure, SHF carried out a series of studies during 2016 in order to identify the main challenges facing housing developers.

The complexity of housing developers to carry out urbanization tasks for housing was identified, particularly when seeking to integrate sustainability criteria into developments. Municipalities are responsible for urbanization, but due to precarious financial situation of many, developers assume the task and need additional capital efforts in order to ensure minimum operating conditions for their projects.

The tool design focused on accounting energy and water efficiencies and, therefore, Greenhouse Gas (GHG) emissions associated, as well as the impacts from savings and access to equipment and infrastructure under the sustainable modality.

Read MoreAs part of the methodological process, the objectives contained in the UN 2030 Agenda on Sustainable Development prepared during 2015 were integrated, particularly those related to water management, resilience and inclusion and security of population.

As a result of this methodological approach and the tool that automates modeling, the central benefit for SHF is the quantification of the economic benefit, considering additionality, transparency, traceability and ownership of certificates.

The development of clear and structured criteria in urban projects makes it possible to clearly define the economic, social and environmental impact, enabling the mobilization of actions for sustainable investments in this sector.

Goals

The Financial Innovation Laboratory (LAB Mexico) is a multi-sectoral and institutional dialogue space that promotes debate and the exchange of experiences in green finance, with the participation of the public and private sectors in the generation of financial innovations that support sustainable development of Mexico.

LAB Mexico is a project initiated by the Association of Banks of Mexico (ABM), the BMV Advisory Council on Green Finance, the German Corporation for International Cooperation (GIZ) and the Inter-American Development Bank (IDB).

Key challenges are:

• Create a shared and transparent agenda of initiatives that support the integration and coordination of similar projects, avoiding efforts dispersion.

• To be recognized as a space that encourages debate and innovation in the field of green finance.

• Identifying existing best practices and promote them instead of creating new ones, avoiding duplications that dilute their impact.

• Awaken interest in private and public institutions in joining this Laboratory, contributing with knowledge or resources to accelerate its impact.

• Identify bottlenecks to private investment in green financing, particularly energy, transport, agriculture and water, among others.

• Design innovative financial instruments to promote climate investments.

The LAB is organized into three working groups (GT) that help to structure the projects according to their mission: (1) Green Banks (2) Sustainable Investments and (3) Sectoral Initiatives.

Read MoreRegarding Green Banks, it has been possible to promote a culture of climate risks through the provision of workshops, where banks have actively participated.

From the sectoral point of view, two initiatives have been structured: sustainable transport and distributed generation. This seeks to promote the financing agenda in these two sectors that have remarkable opportunity for development.

With strong convening power, development banking is a major player in this initiative, supporting sectoral efforts in climate finance. One of the activities with which LAB seeks to generate value is the coordination and integration of initiatives of the main actors in climate finance, avoiding duplication and dispersion of efforts. LAB will continue adding more institutions that contribute to the development of Green finance.

Goals