Private Sector

The private sector plays a key role in achieving the Sustainable Development Goals and in supporting solutions that allow everyone to succeed financially in a low-carbon world.Additionally, international investors are increasingly requiring their portfolio companies to report on sustainability and climate change issues. Every sector in the market will need to transform and integrate climate change risks and opportunities to improve their business operations.

IDB Group, particularly through IDB Invest, seeks to provide private sector solutions in Latin America and the Caribbean by supporting companies and projects to achieve financial results that advance the region's sustainable development. Read More

Scope of Activities

Support the private sector to move towards a low-carbon and climate-resilient economy through:Climate Finance

IDB Invest offers thematic financial products such as green bonds, green loans, trade and supply chain financing, guarantees, and capital investments, among others, both in US dollars and in local currencies.

IDB Group supports the development of regulatory frameworks and encourages innovative sectorial initiatives and sustainable financial instruments in the local and international markets.

Advisory Services

Our experts apply their knowledge and experience to provide innovative solutions that enhance the impact of the project in four main areas:

Climate Change, MSMEs and Sustainability, Public-Private Partnerships, and Gender, Diversity and Inclusion.

Advisory services complement financial product offerings to businesses in various sectors such as banking, energy, manufacturing and agriculture by enhancing impact and helping to advance the Sustainable Development Goals (SDGs).

Blended Finance

We have a specialized team assessing projects from a different perspective; they are aware of certain barriers in the market and can intervene by providing concessional financing for high impact projects through blended finance and advisory offerings.

Blended finance offers innovative financial instruments that address structural market, technology, or risk barriers. By meeting certain additionality criteria, blended finance could even support projects with more advantageous rates and provide accompanying advisory services.

Blended finance can be an innovative channel to pursue for projects with actual or perceived risks that are too high to be left to commercial financing alone.

For example, a project may be feasible in economic terms, but it may face difficulties in accessing capital due to lack of familiarity with a particular technology, limited market experience, uncertain income streams or inadequate contractual arrangements.

Resource Mobilization

Nowadays, it is just as important to choose the projects in which to invest as it is to choose the right partners to do so.

Our experience in climate and sustainable finance positions us not only as a strategic partner, but also gives a stamp of approval which helps to attract new investors.

Sectoral Activities

We support projects throughout the LAC region to promote the use of clean energy, implement climate-smart agriculture practices, increase sustainable infrastructure, and expand access to financing for MSMEs by supporting Financial Intermediaries.Financial Institutions

We support banks, funds, microfinance institutions, leasing and factoring companies, among others, with investments and advisory services to facilitate the low-carbon economy and improve access to climate finance.

Read MoreSustainable Infrastructure

We offer innovative financial solutions for the development and operation of projects related to sustainable infrastructure, which promote an increase in access, quality and efficiency of renewable energy, transportation, water and sanitation, as well as social and health services.

Read MoreCorporations

IDB Invest differentiates itself by investing in sustainable, competitive and innovative business models. It is involved in investments that advance sustainable consumption, improve efficiency and productivity, introduce renewable energy and enhance preparedness for the low-carbon and climate resilient economy.

Read MoreWhere it is implemented

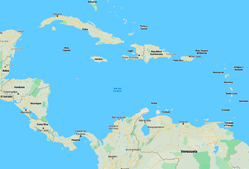

IDB Invest and the IDB Group support private sector companies in Latin America and the Caribbean.

In addition to the headquarters in Washington (U.S.), In addition to the headquarters in Washington (U.S.), IDB Invest has offices in all member countries and also has a larger presence in its four Hubs.

Andean Countries

The Hub of the Andean countries is in Bogota (Colombia). There are also offices in the other countries of the Andean Region.

HUB:

Colombia

Carrera 7 No. 71-21, Torre B, Piso 19, Edificio Davivienda, Bogotá. Tel: + (571) 325-7000

Bolivia

Av. 6 de Agosto # 2818, Zona de San Jorge, La Paz. Tel: + (591) 2217-7704

Ecuador

Avda. 12 de Octubre N24-528 y Cordero, Edificio World Trade Center - Torre II, Piso 9, Quito. Tel: + (5932) 299-6900

Peru

Calle Dean Valdivia No. 148, Piso 10, Lima 27. Tel: + (511) 215-7800

Venezuela

Av. Venezuela, Torre Principal Banco Bicentenario, Piso 3, El Rosal, Caracas. Tel: +(58-212) 955-2900

Caribbean Countries

The Hub of Caribbean countries is in Kingston, Jamaica. There are also offices in all Caribbean member countries.

HUB:

Jamaica

40-46 Knutsford Boulevard 6th Floor, Kingston. Tel: + (876) 764-0815/0852

Bahamas

IDB House, East Bay Street Nassau. Tel: + (1-242) 396-7800

Barbados

“Hythe” Welches Maxwell Main Road BB17068, Christ Church. Tel: + (1-246) 627-8500

Haiti

Bourdon 389, Boite Postale 1321, Port-au-Prince. Tel: + (509) 2812-5000/5048

Surinam

Peter Bruneslaan 2-4, Paramaribo. Tel: +(597) 52-1201

Trinidad and Tobago

17 Alexandra Street, St. Clair, Port of Spain. Tel: +(1-868) 822-6400

Central American Countries, Haiti, Mexico, Panama and the Dominican Republic

IDB Invest has offices in all Central American countries as well as nearby countries such as Mexico and the Dominican Republic. The Hub is located in Panama City (Panama) and there are offices in all the countries of the Central American Region.

HUB:

Panamá

Tower Financial Center, Piso 23 Calle 50 y Elvira Méndez. Tel: + (507) 206-0927

Belice

1024 Newtown Barracks 101 1st Floor Marina Towers Building, Belize City. Tel: +(501) 221-5300

Costa Rica

Centro Corporativo El Cedral, Edificio A. Piso , 300 mts Este del Peaje Autopista Próspero Fernández Trejos Montealegre, Escazú, Apartado postal 1343-1250, San José. Tel: + (506) 2588-8748

Dominican Republic

Calle Luis F. Thomen Esquina Winston Churchill Torre BHD, piso 10, Santo Domingo. Tel: +(1-809) 784-6400

El Salvador

Edificio World Trade Center Torre 1, 4º Nivel Calle El Mirador y 89 Avenida Norte San Salvador. Tel + (503) 2233-8900 ext. 2201

Honduras

Colonia Lomas del Guijarro Sur Primera Calle, Tegucigalpa, Honduras. Tel: + (504) 2290-3500

Mexico

Avenida Paseo de la Reforma Nº 222 Piso 11 Colonia Juárez, Delegación Cuauhtémoc, México, D.F. 06600. Tel: + (52-55) 5141-2492

Nicaragua

Boulevard Jean Paul Genie, de la Rotonda Jean Paul Genie 970 mts. al oeste (M/D) Managua. Tel: + (505) 2264-9140

Southern Cone Countries

The Hub of the Southern Cone countries is located in Buenos Aires (Argentina). There are also offices in the rest of the Southern Cone countries.

HUB:

Argentina

BID Invest Argentina: Esmeralda 130 Piso 17. C1035ABD, Buenos Aires. Tel: + (54 11) 4320-1800

Brazil

Setor de Embaixadas Norte Quadra 802, Conjunto F, Lote 39 Asa Norte Brasilia. Tel: + (55 61) 3317-4200

Chile

Avda. Pedro de Valdivia 0193 Pisos 10 y 11 Providencia Santiago. Tel: + (562) 2431-3707/3719

Paraguay

Quesada 4616 esq. Legión Civil Extranjera – Piso 1 Asunción. Tel: + (595 21) 616-2320

Uruguay

Rincón 640 11.000 Montevideo. Tel: + (598) 2915-3696

Why is it crucial to drive the Private Sector towards Green Transition?

There is a progressive shift in the private sector's perception of the importance of sustainability as a key attribute of business performance. In this regard, the financial impact related to extreme weather events, increasing regulatory pressures, the need to disclose climate-related risks that pose a threat to business, and the growing dissemination of information on the adverse effects climate change are key aspects that influence the market's assessment of companies.Read More

Featured projects

From the sustainable and climate aspect, IDB Invest is a key player in sustainability and climate finance. We strategically support projects and sectors that have the potential to catalyze sustainable economic development. Currently, at least 30% of all IDB Invest’s financing is climate finance.

Sudameris ▾

The Rotonda ▾

Autopistas Urbanas ▾

Mortgage Finance Company ▾

Millicom ▾

Solar Energy Project in Pirapora▾

Sudameris

In the financial sector, the Paraguayan bank Sudameris is leveraging new technologies to introduce new sustainable business practices. The financial institution uses Global Forest Watch, an online platform offering real-time data to monitor and be alerted if a fire threatens any of its investments, or if a timber client is trading in species from protected areas, information that is of great value for its risk management plans.

La Rotonda

La Rotonda is an Argentine platform that brings together producers and rural contractors in what some have called an "uberization of the countryside”. This initiative allows producers to offer or request agricultural services directly through georeferencing and prevents them from having to go through intermediaries each season.

Autopistas Urbanas

Sustainable infrastructure can be significantly enhanced by digital innovation. In transportation, as part of a new collaboration with Waze, IDB Invest is working with Autopistas Urbanas (AUSA) in Argentina, to provide real-time accident data and traffic statistics, in order to better understand the impact on road safety.

Trinidad and Tobago Mortgage Finance Company (TTMF)

IDB Invest executed a partial credit guarantee to support TTMF’s bond issuance with the objective of expanding its mortgage offering and continuing to provide financial products focused on the specific needs of the most disadvantaged populations.

Millicom

IDB Invest offered long-term financing to Millicom through the subscription of a bond to modernize and expand 3G and 4G networks in Bolivia, Colombia, Costa Rica, El Salvador, Honduras, Nicaragua and Paraguay.

Solar Energy Project in Pirapora

IDB Invest provided a loan guarantee for a solar energy project in Pirapora, in the state of Minas Gerais. The guarantee supported the issuance of a long-term infrastructure bond in the local market. This included a “bridge loan” provided by IDB Invest for the construction of a second phase of the solar energy complex.

Stay updated on the latest trends of Green Finance

Stay updated on the latest trends of Green Finance