- Home

- »

- Our Initiatives

- »

- Climate Risks

Climate Risk for Development

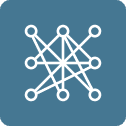

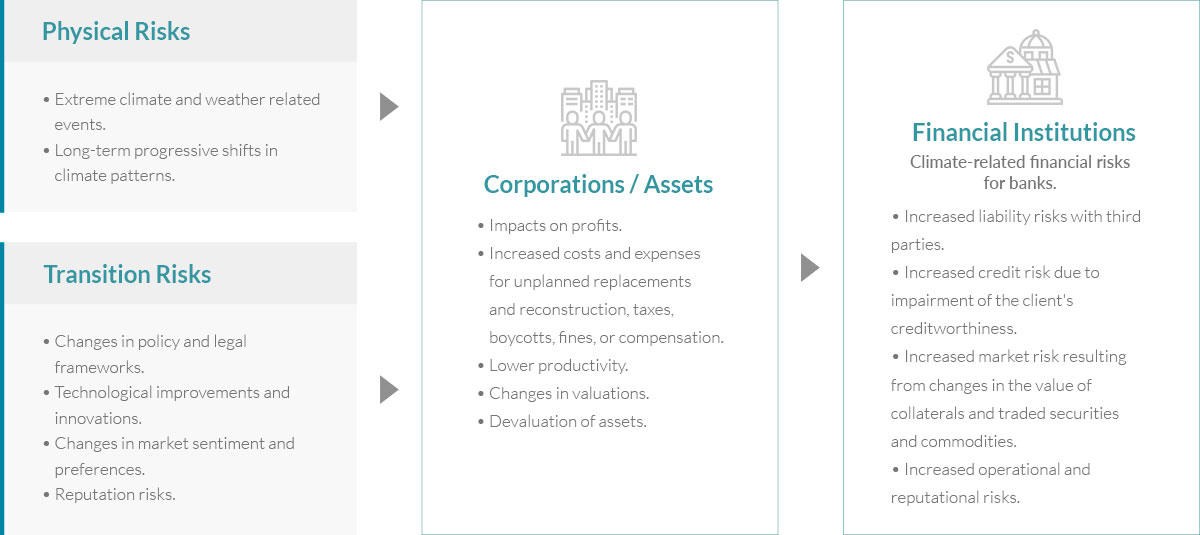

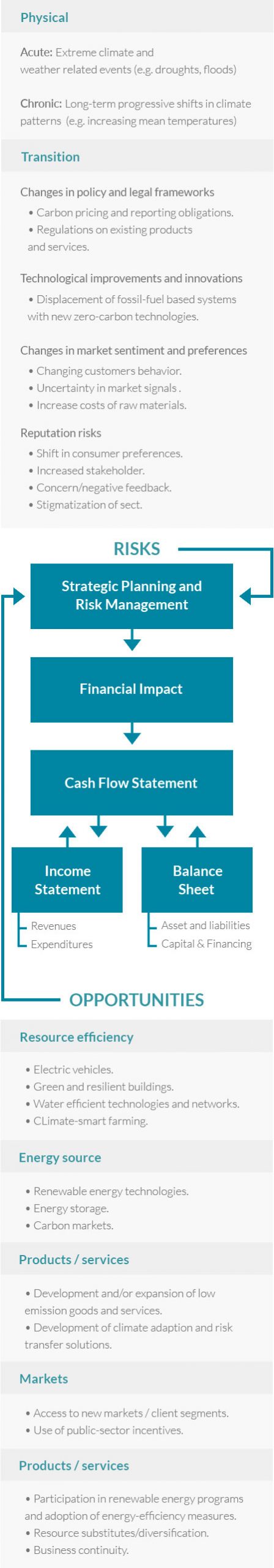

Climate change, and society’s response to it, present financial risks and opportunities to financial institutions and corporates. These risks, or opportunities, can stem from two primary channels:- Physical risks arise from the physical effects of increasingly severe and frequent climate and weather-related extreme events such as droughts, floods or hurricanes, and from longer-term progressive shifts in climate patterns such as increasing mean temperatures and changes in precipitation. These events can result in direct damages to property and other infrastructures, disrupt supply chains or impact of agricultural output, thereby reducing asset values and companies’ profitability.

- Transition risks arise from the process of adjustment towards a carbon-neutral economy and be prompted by changes in policy, regulations, technology, or market sentiment. Policy changes could for instance take the form of restrictions on carbon emissions, the implementation of carbon pricing or the tightening of energy efficiency standards. These changes can translate in rapid reassessment of a wide range of asset values through unanticipated or premature write-downs of carbon-intensive industries.

Scope of Activities

The IDB Group supports its clients in identifying, assessing, and managing climate-related risks and opportunities. It does so through an integral offering encompassing:Innovative Solutions

Financial and non-financial solutions supporting investments in climate solutions.

Business Models

Design and piloting of innovative business models.

Task Force on Climate-related Financial Disclosures (TCFD)

Implementation of the TCFD’s recommendations.

Thematic Bonds

Issuance of thematic bonds.

Intersectoral Dialogue

Promotion of public-private dialogues on the topic through its Innovation LABs, and actively foster international knowledge sharing.

IDB Group’s climate risk-related support activities

Why climate risks?

Climate-related risks influence the characteristics of traditional risk types and affect how those risks impact financial institutions. For banks, for instance, climate-related risks can manifest as increased credit risk, market risk, liquidity risk and operational risk. .Primary channels for climate-related financial risks

Managing climate risk allows overcoming barriers such as:

- Financial instability due to climate change

- Reduced asset values and companies’ profitability due o physical effects of increasingly severe and frequent climate and weather-related extreme events

- Lower ratings by agencies as climate risk factors are incorporated into their credit rating opinions

- Rapid reassessment of a wide range of asset values through unanticipated or premature write-downs of carbon-intensive industries given an adjustment towards a carbon-neutral economy, prompted by changes in policy, regulations, technology, or market sentiment

Resources

Stay updated on the latest trends of Green Finance

Stay updated on the latest trends of Green Finance