- Home

- »

- Publications

- »

- Post-Issuance Reporting in the Green Bond Market 2021

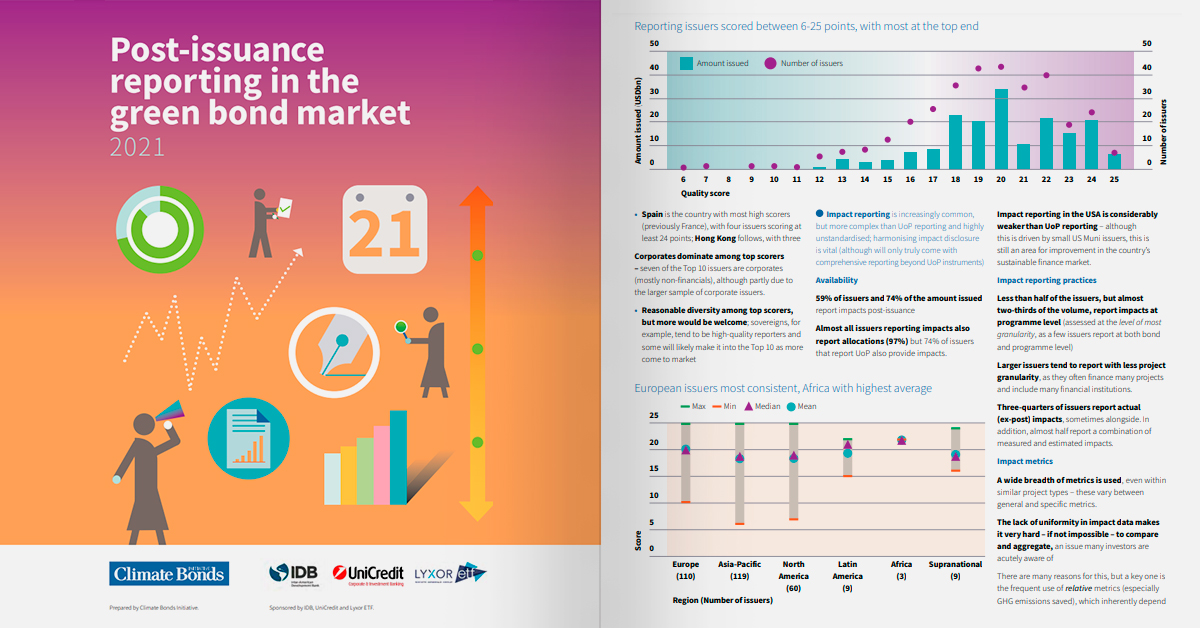

Editor/s: Prepared by Climate Bonds Initiative. Sponsored by IDB, UniCredit and Lyxor ETF

Author/s: Miguel Almeida (Lead); Prashant Lonikar (Co-author)

File: Download PDF

Climate Bonds Initiative (CBI), with the support of the Inter-American Development Bank (IDB), UniCredit and Lyxor ETF, recently released the “Post-Issuance Reporting in the Green Bond Market 2021” report, looking into the availability and attributes of use-of-proceeds (UoP) and impact disclosure among green bonds. It is the third iteration of this report, which is published on a biennial basis.

The report provides an in-depth review of green bond reporting, shedding light on post-issuance reporting practices and identifying avenues for further improvement in this space. Post-issuance UoP reporting is a core component of the Green Bond Principles (GBP) and the Green Loan Principles (GLP), and it is also recommended that issuers report on the environmental impacts achieved. The analysis is based on a review of green bonds included in the Climate Bonds Green Bond Database issued between Q4’17 and Q1’19.

The overarching goal of this research report is to facilitate the continued evolution of sustainable finance. Aimed at investors, issuers, regulators and other finance professionals, the report provides an understanding of the status quo and future of sustainability reporting.

Some of the key findings include:

• Availability of post-issuance reporting is widespread, but UoP still more commonly reported than impacts

• Larger issuers are more likely to report

• Developed Markets (DM) tend to have higher share (and quality) of reporting. Latin America still show near to 50% non-reporting share (in terms of amount issuance)

• The quality and consistency of reporting vary more significantly: key aspects include providing clear, easily accessible and granular information, as well as reporting in line with commitments at issuance and obtaining external reviews.

An expanding market, together with increasing guidance and developments in reporting practices, have contributed to a rich and varied reporting landscape. However, this varied landscape is difficult to navigate and could cause ambiguity for investors and analysts of the green bond market.

Harmonisation of disclosure must be the priority, in the absence of a common framework to report within, issuers must independently plan, create and publish green bond reports. A common standardised reporting framework and platform leading to greater availability, quality and consistency of disclosure globally is an important next step in the green bond market.

Beyond UoP instruments there is an urgent need for comprehensive sustainability reporting to create a purpose-driven economy with impact measurement at its core.

Stay updated on the latest trends of Green Finance

Stay updated on the latest trends of Green Finance